FIX API Terminal is an innovative trading platform developed through close collaboration between traders and programmers. Unlike most existing solutions, it provides direct and transparent access to the Forex market, bypassing broker servers and thereby eliminating the possibility of trade manipulation.

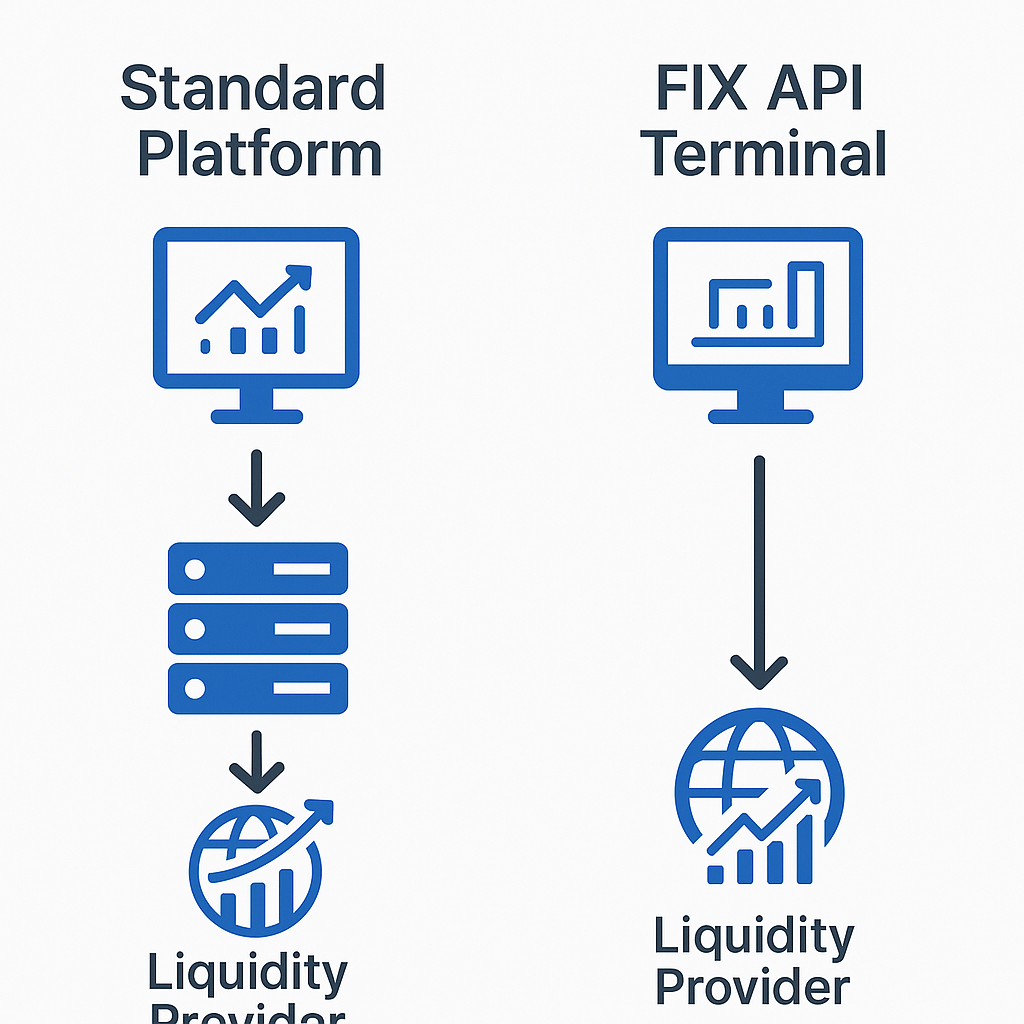

Traditional trading platforms are built on an architecture where the broker’s server is the central element. This setup inevitably creates a conflict of interest: the broker can control order execution, delay quotes, or use third-party plugins to manipulate trades. Moreover, the presence of intermediary servers increases the latency between receiving quotes and executing trades — a critical issue for high-frequency and arbitrage strategies.

This architecture did not arise by chance: most popular platforms were developed by technology providers at the request of brokers, who are willing to pay significant sums for the ability to monitor and control client trading activity.

In contrast, FIX API Terminal is a fundamentally different kind of platform. It is a pure STP system (Straight Through Processing), operating without intermediary servers. It is designed with the trader’s interests in mind, ensuring the fastest, fairest, and most independent order execution possible.

What Is FIX API and Why Does It Matter for Traders?

What Is FIX API and Why Does It Matter for Traders?

FIX API (Financial Information Exchange Protocol) is a standard for direct connectivity with a liquidity provider, exchange, or other financial institution, completely bypassing the broker’s platform.

Think of trading via standard Forex trading platforms like driving a car through a city full of traffic lights and checkpoints. FIX API, on the other hand, is a high-speed expressway with no stops, where you’re directly connected to the source of quotes and execution.

Key Advantages of FIX API for Traders

✅ Maximum Execution Speed

You receive quotes and place orders directly — no detours through broker servers. This is especially important for arbitrage and HFT strategies.

✅ Fair Execution Without Broker Interference

Brokers cannot see your strategies, delay execution, or use plugins to manipulate trades. FIX API eliminates such risks entirely.

✅ Advanced Order Types

You can use order types not available in standard Forex trading platforms, such as:

• LIMIT FOK (Fill or Kill),

• IOC (Immediate or Cancel),

providing you greater control over trade entries.

✅ High Stability and Independence

You’re no longer dependent on broker-side outages or unstable trading platforms. FIX API is the professional-grade solution trusted by banks and hedge funds.

✅ Flexible for Automation

You can build your own robots, integrate third-party algorithms, and connect any analysis system — all without limitations from broker-side restrictions.

In Short:

FIX API is a professional-grade tool that offers the speed, transparency, and control standard platforms simply cannot provide.

Why It’s More Profitable: Real Numbers That Matter

If you’re an active trader dealing with large volumes, your monthly losses from standard platforms may be much higher than you realize.

Let’s break it down:

💼 Suppose you trade $100,000,000 in volume per month:

| Costs via a typical broker | Calculation | Total |

| Spread (avg. 1.2 pips on EUR/USD) | ~$12 per lot → $12 × 1,000 lots | $12,000 |

| Broker commission | ~$7 per lot round-turn × 1,000 lots | $7,000 |

| Slippage and hidden costs | ~$5 per lot × 1,000 lots | $5,000 |

| Monthly total | $24,000 |

📈 Now compare it to FIX API:

| Costs via FIX API | Calculation | Total |

| Liquidity provider commission | ~$3.5 per lot round-turn × 1,000 lots | $3,500 |

| ECN spread (avg. 0.1–0.2 pips) | ~$2 per lot × 1,000 lots | $2,000 |

| Minimal slippage thanks to LIMIT FOK orders | Estimated | $500 |

| Monthly total | $6,000 |

🔥 Additional Profit:

$24,000 − $6,000 = $18,000 per month

or

$216,000 per year, simply by switching to FIX API.

FIX API is not only about fair execution — it’s about real cost savings. The higher your trading volume, the more you lose when using traditional brokers — and the more you stand to gain from direct market access.

Integration of Robots and Advanced Orders in FIX API Terminal

During the development of the FIX API Terminal, we recognized that traders have relied heavily on trading robots and indicators developed for the MT platform over the years. To preserve this valuable ecosystem and ease the transition to the FIX API Terminal, we built a compiler that converts MQL code into DLL libraries, which can be used within our terminal.

As a result, FIX API Terminal users retain access to their existing algorithms and automated strategies — and can run them in a more stable, broker-independent environment.

Support for Advanced Order Types: What Is LIMIT FOK?

One of the key advantages of FIX API Terminal is the ability to work directly with liquidity providers. This enables access to advanced order types that are not available on most standard platforms — including LIMIT FOK (Fill or Kill).

A LIMIT FOK order is a limit order that must be executed immediately and in full at the specified price or better. If full execution isn’t possible at the moment the order is sent, it is cancelled entirely. This is crucial for algorithmic and high-frequency trading, where partial fills can lead to risk exposure and slippage.

Automatic LIMIT FOK Integration for MQL Robots

To ensure your existing MQL robots can also benefit from LIMIT FOK orders, we implemented a feature that automatically replaces the standard market order commands with logic that generates LIMIT FOK orders. You don’t need to rewrite your strategy from scratch — just compile it using our tool, and your robot will start working with direct market access and more precise, protected order execution.

You Have Access to FIX API Terminal — What Does That Mean for You?

With FIX API Terminal, you gain a platform that offers direct connection to liquidity providers, bypassing broker servers. This isn’t just a technical edge — it’s real savings on commissions, full protection from broker interference, and continued use of your favorite MQL robots via our integrated compiler.

But what else makes FIX API Terminal such a powerful tool?

📊 Arbitrage Trading Without Limits

FIX API Terminal supports multi-account trading, which unlocks all kinds of arbitrage strategies:

• Compare quotes between Account A and Account B and react to discrepancies in real time.

• Build trade copiers: copy trades from one account to many (e.g., from Account A to B, C, D…).

• Implement 2-leg or 3-leg arbitrage, intra-broker or inter-broker — all within a unified environment.

⚙️ Compatibility with Leading Platforms

FIX API Terminal already supports accounts on:

• DXTrade

• NinjaTrader

• MatchTrader

• cTrader

This makes it easy to build strategies for prop firm challenges, automate trading, and test across different platforms — all from a single, integrated system.

Final Word:

FIX API Terminal is not just another trading platform. It is a versatile, professional-grade solution that brings together:

• Direct market access

• Commission savings

• MQL robot integration

• Full flexibility for arbitrage and trade copying strategies

• Multi-platform trading support

FIX API Terminal puts control back where it belongs — in the hands of the trader, not the broker. Download FIX API Terminal for free.

❓ Frequently Asked Questions (FAQ)

🔹 What makes FIX API Terminal different from other Forex trading terminals?

FIX API Terminal connects you directly to liquidity providers, bypassing broker servers entirely. This eliminates manipulation, reduces latency, and ensures faster, more transparent execution. Other Forex trading platforms, by contrast, route trades through the broker’s infrastructure — opening the door to slippage, delays, and strategy surveillance.

🔹 Do I need to rewrite my existing MT robots to use FIX API Terminal?

No. FIX API Terminal includes a built-in compiler that converts your MQL code into DLLs compatible with our terminal. Your existing strategies continue to work — now with better execution and without broker-side interference.

🔹 What is LIMIT FOK, and why is it important?

LIMIT FOK (Fill or Kill) is a professional-grade order type that executes your trade only if the entire volume is available at the specified price. If not — the order is instantly canceled. This protects algorithmic and HFT strategies from partial fills, delays, and price slippage.

🔹 How much can I save by switching to FIX API Terminal?

Based on typical trading volumes, users can save up to $18,000 per month (or over $200,000 annually) on spreads, commissions, and slippage. These are real, measurable savings — especially for high-volume or arbitrage traders.

🔹 Can I use FIX API Terminal with prop firm accounts?

Yes. FIX API Terminal supports accounts on DXTrade, NinjaTrader, MatchTrader, and cTrader — all commonly used by proprietary trading firms. This makes it easier to pass prop firm challenges and automate strategies across platforms.

🔹 Is FIX API Terminal suitable for arbitrage and HFT?

Absolutely. The platform is optimized for latency-sensitive strategies and supports multi-account setups for:

- 2-leg and 3-leg arbitrage

- Trade copying between accounts

- Real-time quote comparisons across brokers

🔹 Do brokers see my trades or strategies on FIX API Terminal?

No. Unlike a standard forex trading platform, where brokers can track your activity, FIX API Terminal provides complete strategy privacy. Brokers cannot monitor, delay, or manipulate your trades.

🔹 Is FIX API Terminal stable and secure?

Yes. FIX API Terminal operates independently of broker platforms, avoiding their outages or malfunctions. It uses the same FIX protocol trusted by banks and hedge funds worldwide.

🔹 Where can I open a FIX API account with a low minimum deposit?

You can open a cTrader account and request FIX API credentials directly. Here’s the official guide on how to obtain them:

👉 How to get FIX API credentials in cTrader

Additionally, brokers like Fxpig and PFD-NZ offer FIX API accounts with minimum deposits starting from $500, making direct market access accessible to independent traders.

🔹 What kind of support is available?

Our team provides documentation, integration guides, and tools to help compile your robots and configure While direct support for coding is not provided, the system is built to be developer-friendly and robust for custom automation.